Australia recorded 97,037 new vehicle sales in November, a 2.1 per cent decrease on the same month last year. The latest VFACTS data shows shifting buyer preferences, including rapid growth in plug-in hybrid electric vehicles (PHEVs).

PHEVs were a standout performer. Across passenger, SUV and light commercial segments, PHEV sales reached 4,768 for the month, up 83.3 per cent on November 2024.

Year to date, PHEV sales have surged 130.6 per cent to 47,565 units as more models enter the market and consumer awareness increases. Petrol vehicles continued their downward trajectory, with overall petrol sales falling 18.1 per cent in November and 9.5 per cent year to date.

Federal Chamber of Automotive Industries chief executive Tony Weber said the results point to a sustained shift in buyer priorities.

“Plug-in hybrids continue to gain momentum because they give drivers the benefits of electric travel for daily use while removing range concerns. Consumers are looking for flexible, low-emission choices and brands are meeting that demand,” Mr Weber said.

“Petrol’s decline is part of a long-term global market transition. We are seeing strong interest in hybrid and plug-in hybrid vehicles, and this trend will only accelerate as more models arrive.”

Battery electric vehicles (BEVs) from all sources accounted for 9.1 per cent of sales in November, up from 6.5 per cent in 2024. BEVs now represent 8.2 per cent of the market year to date, compared to 7.4 per cent for the same period last year.

“The choice of BEVs provided by manufacturers is growing, with 110 models in the market in 2025,” Mr Weber said.

“We encourage governments to continue to invest in recharging infrastructure to support growth in consumer confidence in this new technology.”

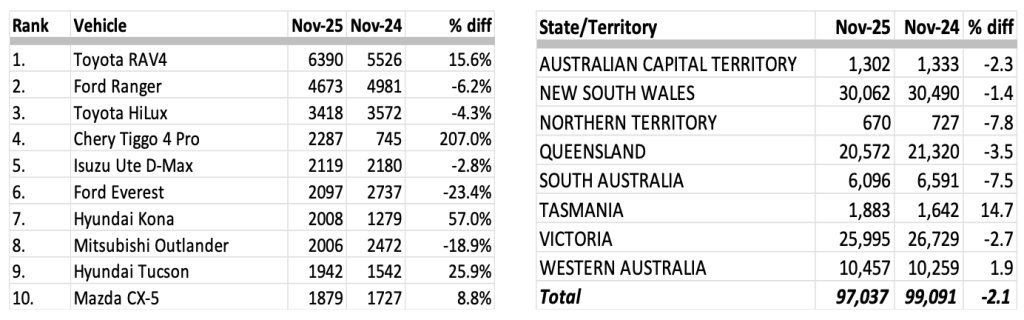

Passenger cars experienced another significant contraction, dropping 15.7 per cent for the month, and 23.2 per cent year to date, representing 11.8 per cent of sales in November 2025. In comparison, SUVs have grown 5.4 per cent over the year and make up more than 60.5 per cent of the market. Toyota was the market leader with sales of 19,787 during November, followed by Ford (7,407), Mazda (6,979), Hyundai (6,707) and Kia (6,510). The top models were the Toyota RAV4 (6,390), Ford Ranger (4,673), Toyota HiLux (3,418), Chery Tiggo 4 Pro (2,287) and Isuzu Ute D-Max (2,119).

Sales in the Australian Capital Territory were down 2.3 per cent on November 2024 to 1,302; New South Wales was down 1.4 per cent (30,062); Northern Territory was down 7.8 per cent (670); Queensland fell 3.5 per cent (20,572); South Australia fell 7.5 per cent (6,096); Tasmania increased 14.7 per cent (1,883); Victoria was down 2.7 per cent (25,995) and Western Australia rose 1.9 per cent (10,457).

VFACTS NOVEMBER 2025

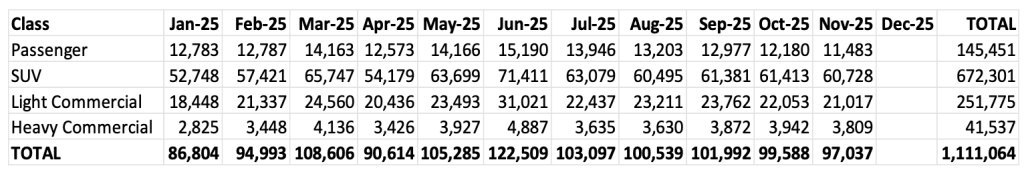

Summary by Class:

Key Points:

- The November 2025 market of 97,037 shows a drop in new vehicle sales of 2,054 (-2.1%) compared to November 2024 (99,091). There were 24.7 selling days in November 2025 compared to 25.7 in November 2024 resulting in an increase of 72.9 vehicle sales per day in November 2025.

- The Passenger Vehicle Market is down by 2,138 vehicle sales (-15.7%) over the same month last year; the Sports Utility Market is up by 116 vehicle sales (0.2%); the Light Commercial Market is up by 463 vehicle sales (2.3%) and the Heavy Commercial Vehicle Market is down by 495 vehicle sales (-11.5%) versus November 2024.

- Toyota was market leader in November, followed by Ford and Mazda. Toyota led Ford with a margin of 12,380 vehicle sales and 12.8 market share points.

SALES RESULTS:

Top 10 Models (by sales volume): State/Territory results (by sales volume):

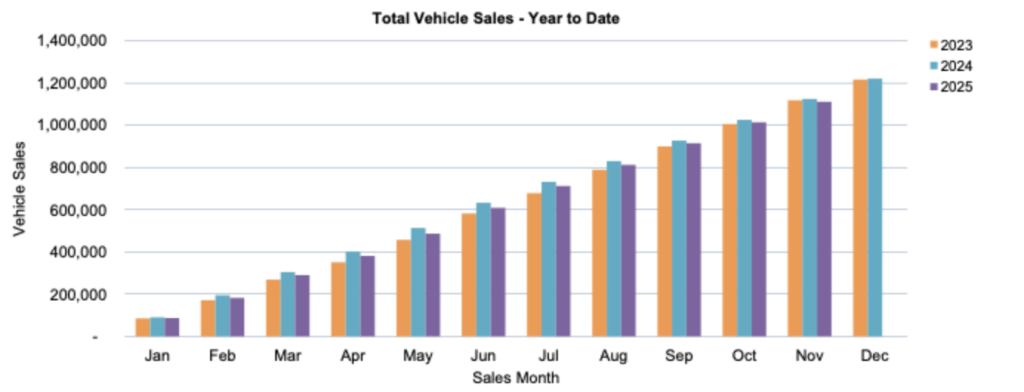

Total Vehicle Sales – Year to Date: