Australians purchased 90,614 new vehicles during April, a decrease of 6.8 per cent on the same period in 2024.

The latest VFACTS data shows a sharp decline in sales of plug-in hybrid electric vehicles (PHEVs) following the removal of the fringe benefits tax (FBT) exemption for these models at the end of March. During April, 2,601 plug-in hybrids were purchased, representing 2.9 per cent of sales. This is down from 4.7 per cent of sales year to date to March 2025.

FCAI chief executive Tony Weber said the figures highlight the impact of government policy decisions on consumer behaviour in the automotive market.

“The earlier inclusion of PHEVs in the FBT exemption played a critical role in making these vehicles accessible to more Australians. Removing that support has led to an immediate and disappointing drop in demand in a price-sensitive vehicle market,” Mr Weber said.

In April, FCAI members reported battery electric vehicle sales that made up 5.9 per cent of the market. This modest result reinforces the scale of the challenge ahead as Australia seeks to meet its emissions reduction goals under the New Vehicle Efficiency Standard (NVES).

“For NVES to succeed, it must be supported by holistic policy settings that assist consumers to move to zero and low-emission technologies, including continued investment in recharging infrastructure,” Mr Weber said.

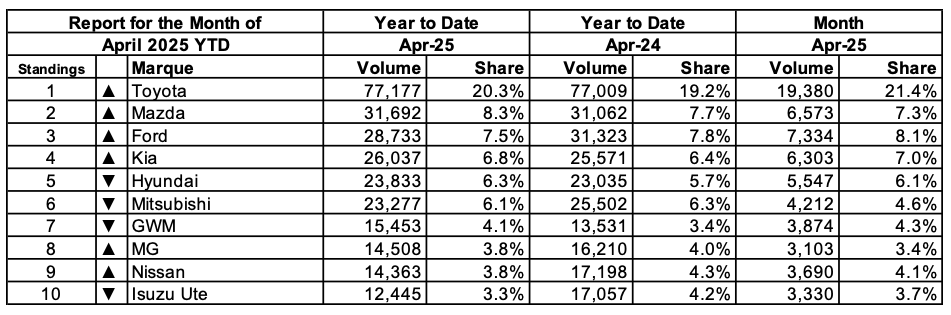

Toyota was the market leader with sales of 19,380 during April, followed by Ford (7,334), Mazda (6,573), Kia (6,303) and Hyundai (5,547).

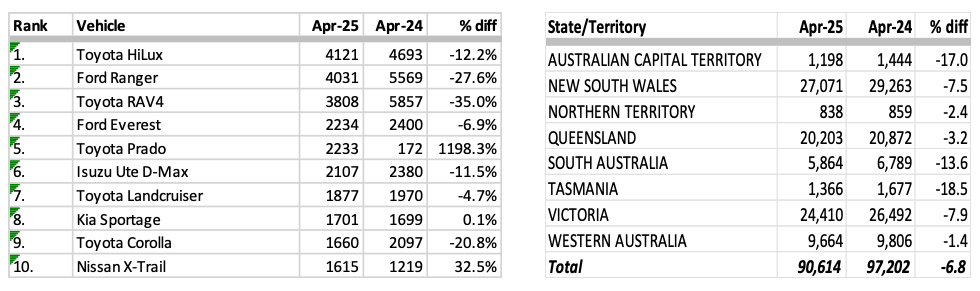

The Toyota HiLux was Australia’s top selling vehicle with sales of 4,121 followed by the Ford Ranger (4,031), Toyota RAV4 (3,808), Ford Everest (2,234) and Toyota Prado (2,233).

For April 2025, sales in the Australian Capital Territory were down 17 per cent on April 2024 to 1,198; New South Wales was down 7.5 per cent to 27,071; Northern Territory decreased by 2.4 per cent to 838; Queensland fell 3.2 per cent to 20,203; South Australia was down by 13.6 per cent to 5,864; Tasmania had a decrease of 18.5 per cent to 1,366; Victoria was down 7.9 per cent to 24,410 and Western Australia decreased 1.4 per cent to 9,664.

VFACTS APRIL 2025

Summary by Class:

Key Points:

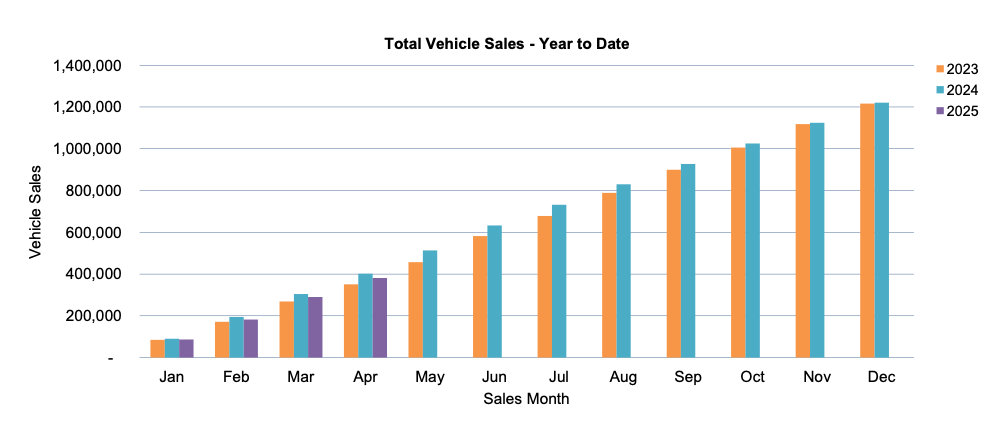

- The April 2025 market of 90,614 shows a decrease in new vehicle sales of 6,588 (-6.8%) compared to April 2024 (97,202). There were 23 selling days in April 2025 compared to 24 selling days in April 2024 resulting in a decrease of 110.3 vehicle sales per day in April 2025.

- The Passenger Vehicle Market is down by 4,741 vehicle sales (-27.4%) over the same month last year; the Sports Utility Market is up by 44 vehicle sales (0.1%); the Light Commercial Market is down by 990 vehicle sales (-4.6%) and the Heavy Commercial Vehicle Market is down by 901 vehicle sales (-20.8%) versus April 2024.

- Toyota was market leader in April, followed by Ford and Mazda. Toyota led Ford with a margin of 12,046 vehicle sales and 13.3 market share points.

SALES RESULTS:

Top 10 Models (by sales volume): State/Territory results (by sales volume):

Total Vehicle Sales – Year to Date

VFACTS monthly vehicle sales data is available on the third working day after the end of every month.