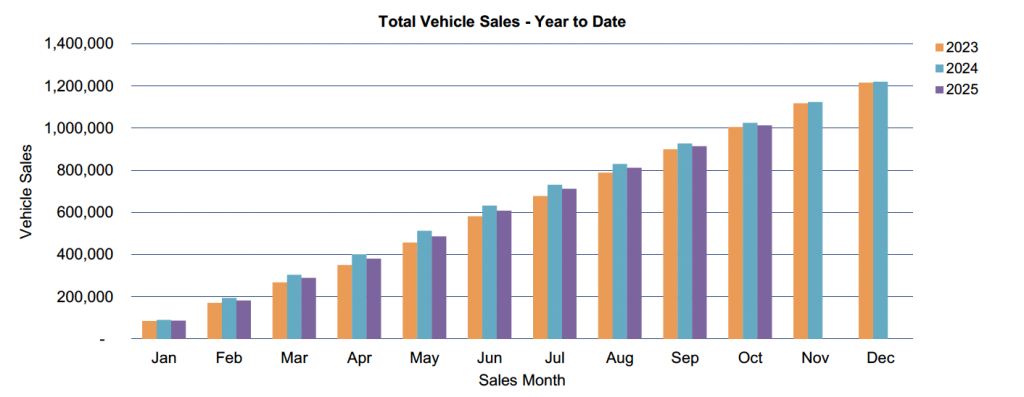

Australia’s new vehicle market remained steady in October with 99,588 sales recorded, up 1.2 per cent on October 2024. Year-to-date sales stand at 1,014,027 – down slightly (1.1 per cent) on the same period last year.

The standout trend for October was the sharp rise in hybrid and plug-in hybrid (PHEV) vehicles.

Hybrids represented 17.8 per cent of sales and PHEVs 4.7 per cent. Battery electric vehicles (BEV) from all sources represent 7.3 per cent. This is a 25 per cent growth for hybrids compared to October last year and 95 per cent for PHEVs, while BEVs remained stable. Year-to-date, hybrids are up 12 per cent while PHEVs are up 137.4 per cent.

Federal Chamber of Automotive Industries chief executive Tony Weber said Australians are clearly making the shift to electrified vehicles which meet a wide range of driving needs.

“The October results confirm that Australians are increasingly choosing hybrid and PHEV models as a practical path towards lower emissions,” Mr Weber said.

“Hybrids are delivering strong growth right across the market, while PHEVs are also gaining momentum. Petrol-only vehicles, on the other hand, continue to lose ground. These shifts underline the pace of change in consumer preferences.”

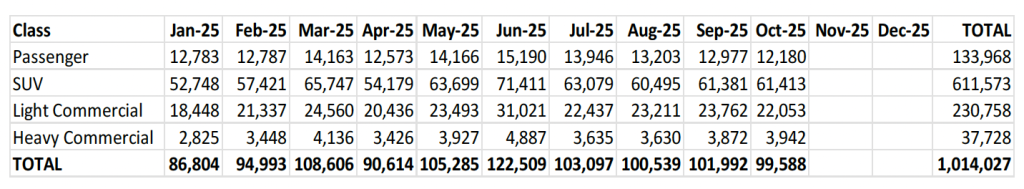

SUVs again dominated the market, accounting for 61.7 per cent of total sales. Medium SUVs alone accounted for one in four vehicles sold, the most popular segment nationally. Passenger vehicles made up just 12.2 per cent of sales.

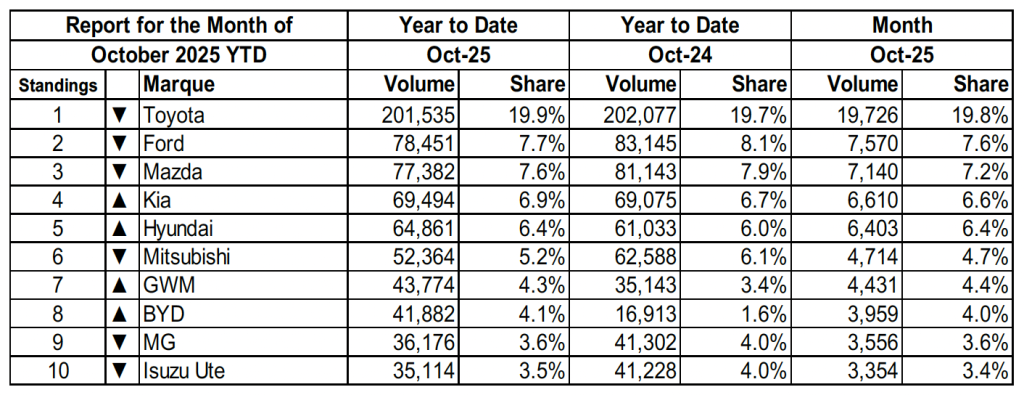

Chinese-built vehicles strengthened their position as the third-largest source market, with sales from China rising 40 per cent year-on-year. Four Chinese brands again featured in the top ten brands for the month.

Toyota was the market leader with sales of 19,726 during October, followed by Ford (7,570), Mazda (7,140), Kia (6,610) and Hyundai (6,403). The top models were the Toyota HiLux (4,444), Ford Ranger (4,402), Toyota RAV4 (4,401), Ford Everest (2,435), and Toyota LandCruiser (2,090). The top five models represented 17.8 per cent of sales.

Sales in the Australian Capital Territory were up 4.0 per cent on October 2024 to 1,350; New South Wales was up 3.7 per cent (30,079); Northern Territory was up 6.7 per cent (910); Queensland fell 5.0 per cent (20,487); South Australia rose 6.7 per cent (6,623); Tasmania increased 6.1 per cent (1,691); Victoria was up 3.6 per cent (27,721) and Western Australia fell 3.1 per cent (11,177).

VFACTS OCTOBER 2025

Summary by Class:

Key Points:

- The October 2025 market of 99,588 shows an increase in new vehicle sales of 1,213 (1.2%) compared to October 2024 (98,375). There were 26.8 selling days in October 2025 compared to 26.4 in October 2024 resulting in a decrease of 10.4 vehicle sales per day in October 2025.

- The Passenger Vehicle Market is down by 3,347 vehicle sales (-21.6%) over the same month last year; the Sports Utility Market is up by 5,261 vehicle sales (9.4%); the Light Commercial Market is down by 124 vehicle sales (-0.6%) and the Heavy Commercial Vehicle Market is down by 577 vehicle sales (-12.8%) versus October 2024.

- Toyota was market leader in October, followed by Ford and Mazda. Toyota led Ford with a margin of 12,156 vehicle sales and 12.2 market share points.

SALES RESULTS:

Top 10 Models (by sales volume): State/Territory results (by sales volume):

Total Vehicle Sales – Year to Date: