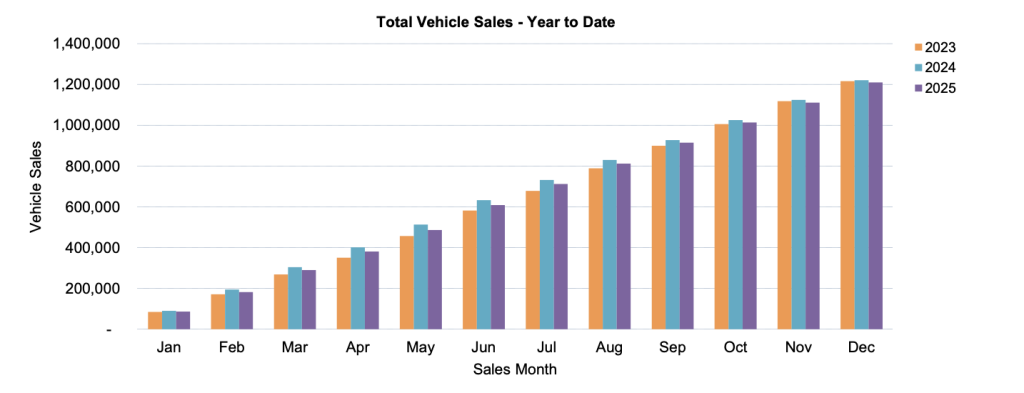

Australia’s vehicle market sold 1,209,808 units in 2025, underscoring the resilience of the automotive industry and reflects sustained consumer demand and the continued evolution of vehicle choice in Australia.

“Consumers are responding to a wide range of models that meet their needs, whether that is family transport, business use or recreation. While overall volumes eased slightly, the market continues to evolve as new technologies become more widely available,” FCAI chief executive Tony Weber said.

Australia’s new vehicle market closed the year on a solid note in December 2025, with 98,744 new vehicles sold, an increase of 3 per cent compared with December 2024.

Growth for plug-in hybrids

Plug-in hybrid vehicles recorded the strongest growth of any drivetrain in 2025, with sales more than doubling to 53,484 units, an increase of 130.9 per cent compared with 2024.

Hybrids also continued to gain momentum, with 199,133 vehicles sold, up 15.3 per cent year on year, reinforcing their role as the most popular lower-emissions option among Australian buyers.

“Many consumers are choosing hybrid and plug-in hybrid vehicles as a practical transition toward lower emissions. While the industry is investing heavily in battery electric technology, uptake ultimately depends on consumer readiness and the availability of reliable public recharging infrastructure,” Mr Weber said.

Battery electric vehicle sales from all sources totalled 103,269 units, accounting for 8.3 per cent of sales for the year.

Despite more than 100 battery electric vehicle models available in Australia, growth in the segment has been slower than expected.

“The growth of battery electric vehicle market share has been anaemic, increasing by 1.1 percentage points over the past two years, well below earlier projections,” Mr Weber said.

Navigating the New Vehicle Efficiency Standard

The automotive industry continues to adapt to the New Vehicle Efficiency Standard, which commenced last year.

Early compliance outcomes will not be known until official reporting is released in coming weeks and, while 2025 targets are relatively achievable, future years introduce substantially tighter limits.

“The NVES has provided policy certainty and has led to an increased availability of EVs in Australia. However, it has had little discernible effect on EV demand,” Mr Weber said.

“There is growing concern about what the impact of NVES will be on vehicle availability, affordability and consumer choice as the Government’s targets become more stringent.”

Review of the Fringe Benefits Tax

International experience shows that sustained EV uptake is closely linked to the availability of consumer incentives and supporting infrastructure.

“Countries such as Germany, the Netherlands, New Zealand and the United States have seen sharp declines in EV sales when incentives were reduced or removed,” Mr Weber said.

“In Australia, remaining support mechanisms such as Fringe Benefits Tax concessions are currently under review. Any policy changes must recognise the clear relationship between incentives and consumer demand, not just vehicle supply.”

China consolidates position as a major vehicle source

Vehicles manufactured in China represented approximately 18 per cent of total new vehicle sales in 2025, up from around 14 per cent in 2024, making China Australia’s third-largest source of vehicles.

Japan remained the largest source country, followed by Thailand. After China, Korea is in fourth place. Together, these four major Asian manufacturing nations represent 80 per cent of the market.

“Asian-manufactured vehicles account for four in every five sold in Australia, reflecting deep, mature and integrated supply chains across the region,” Mr Weber said.

SUVs dominate as passenger car sales continue to slide

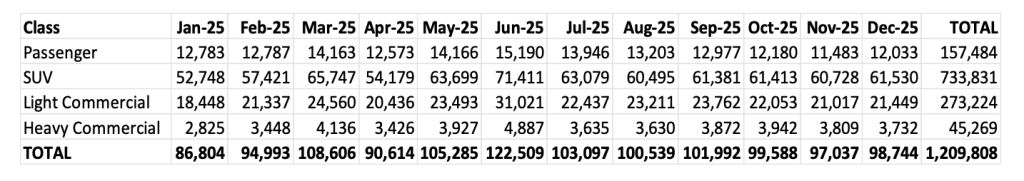

Australian preferences for SUVs increased in 2025, with the segment accounting for 60.7 per cent of total sales, followed by light commercial vehicles at 22.6 per cent and passenger vehicles at 13.0 per cent.

SUV sales rose 5.5 per cent year on year to 733,831 units, while passenger vehicle sales fell sharply by 22.6 per cent to 157,484 units, continuing a long-term structural shift away from traditional sedans and hatchbacks.

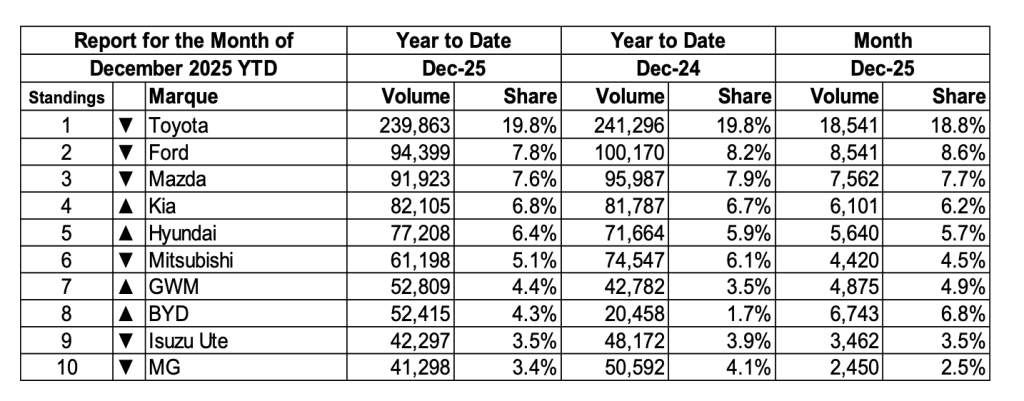

Top brands and models

Toyota was the market leader in 2025 with 239,863 vehicles sold, representing approximately 19.8 per cent of the total market. It was followed by Ford (94,399), Mazda (91,293), Kia (82,105) and Hyundai (77,208).

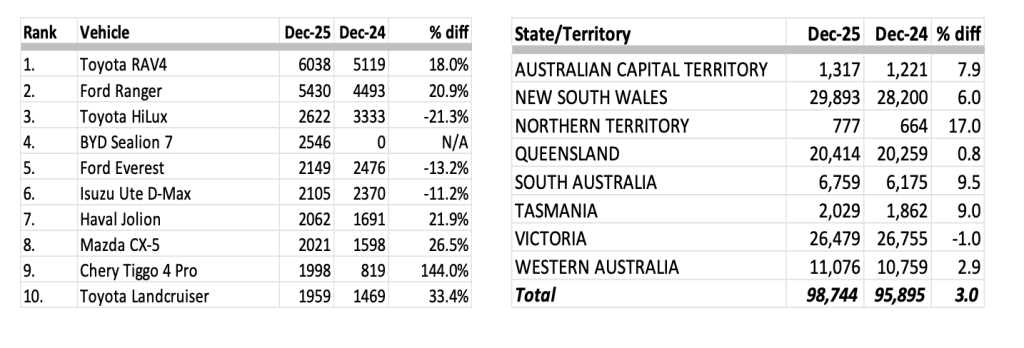

Australia’s top-selling vehicles in 2025 were the Ford Ranger (56,555), followed by the Toyota RAV4 (51,947), Toyota HiLux (51,297), Ford Everest (26,161) and the Toyota Prado (26,106), reinforcing the dominance of SUVs and utes in the national fleet.

Sales by state and territory

During 2025, sales in the Australian Capital Territory fell 3.8 per cent to 16,917; New South Wales declined 0.3 per cent to 367,947; the Northern Territory increased 0.6 per cent to 10,503; Queensland fell 1.3 per cent to 259,903; South Australia declined 2.4 per cent to 78,811; Tasmania fell 2.2 per cent to 19,892; Victoria declined 1.4 per cent to 323,768; and Western Australia increased 1.0 per cent to 132,067.

VFACTS DECEMBER 2025

Summary by Class:

Key Points:

- The December 2025 market of 98,744 shows an increase in new vehicle sales of 2,849 (3.0%) compared to December 2024 (95,895). There were 25 selling days in December 2025 compared to 24 in December 2024 resulting in a decrease of 45.9 vehicle sales per day in December 2025.

- The Passenger Vehicle Market is down by 1,972 vehicle sales (-14.1%) over the same month last year; the Sports Utility Market is up by 3,653 vehicle sales (6.3%); the Light Commercial Market is up by 1,611 vehicle sales (8.1%) and the Heavy Commercial Vehicle Market is down by 443 vehicle sales (-10.6%) versus December 2024.

- Toyota was market leader in December, followed by Ford and Mazda. Toyota led Ford with a margin of 10,000 vehicle sales and 10.2 market share points.

SALES RESULTS:

Top 10 Models (by sales volume): State/Territory results (by sales volume):

Total Vehicle Sales – Year to Date: