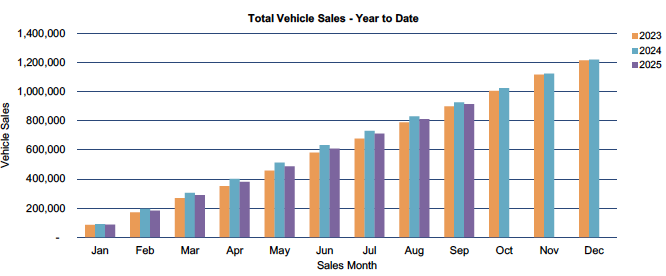

The Australian automotive market recorded 101,992 new vehicle sales in September 2025, bringing the year-to-date total to 914,439. This was 5.1 per cent higher than September 2024, although year-to-date sales remain down 1.4 per cent on last year.

China’s rise as a source of new cars continued in September, becoming the second-largest country of origin. In addition, China accounts for 77.5 per cent of all battery electric vehicle (BEV) sales this year.

BEVs from all sources made up around 11.3 per cent of all new vehicle sales for the month, lifting their year-to-date share to 8.1 per cent.

Plug-in hybrids (PHEVs) recorded 4,491 sales or 4.4 per cent of the market in September, lifting their year-to-date share to 4.2 per cent.

Federal Chamber of Automotive Industries chief executive Tony Weber said the results showed encouraging signs from a low base for EV uptake, but further action is required to accelerate the transition.

“There is no shortage of battery electric vehicles on the market in Australia. With more than 100 BEVs and more than 50 PHEVs available, manufacturers have worked hard to provide Australians with high-quality electric vehicles. What is needed now is a stronger focus on encouraging demand, in particular public recharging infrastructure,” Mr Weber said.

Mr Weber said the challenge was to broaden EV ownership beyond early adopters.

“More needs to be done to give mainstream buyers the confidence to consider EVs in the future. We need to move EV ownership beyond early adopters to mainstream Australians if we are to deliver the ambitious transition that the Government is seeking,” Mr Weber said.

“The industry welcomes the Federal Government’s recent $40 million commitment to public charging infrastructure. This is an important first step towards boosting both public and private investment. If the transition is to gain greater momentum, more support will be needed.”

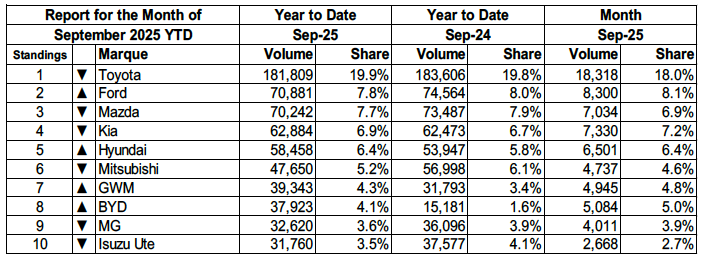

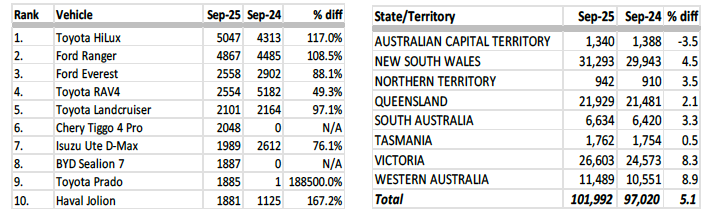

Toyota was the market leader with sales of 18,318 during September, followed by Ford (8,300), Kia (7,330), Mazda (7,034) and Hyundai (6,501). The top models were the Toyota HiLux (5,047), Ford Ranger (4,867), Ford Everest (2,558), Toyota RAV4 (2,554) and Toyota Landcruiser (2,101).

Sales in the Australian Capital Territory were down 3.5 per cent on September 2024 to 1,340; New South Wales was up 4.5 per cent (31,293); Northern Territory was up 3.5 per cent (942); Queensland rose 2.1 per cent (21,929); South Australia rose 3.3 per cent (6,634); Tasmania increased 0.5 per cent (1,762); Victoria was up 8.3 per cent (26,603) and Western Australia rose 8.9 per cent (11,489).

VFACTS SEPTEMBER 2025

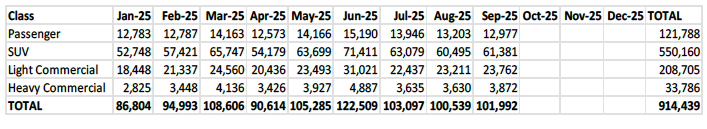

Summary by Class:

Key Points:

- The September 2025 market of 101,992 shows an increase in new vehicle sales of 4,972 (5.1%) compared to September 2024 (97,020). There were 25.6 selling days in September 2024 compared to 24.6 in September 2025 resulting in an increase of 40.2 vehicle sales per day in September 2025.

- The Passenger Vehicle Market is down by 1,511 vehicle sales (-10.4%) over the same month last year; the Sports Utility Market is up by 4,941 vehicle sales (8.8%); the Light Commercial Market is up by 2,183 vehicle sales (10.1%) and the Heavy Commercial Vehicle Market is down by 641 vehicle sales (-14.2%) versus September 2024.

- Toyota was market leader in September, followed by Ford and Kia. Toyota led Ford with a margin of 10,018 vehicle sales and 9.9 market share points.

SALES RESULTS:

Top 10 Models (by sales volume): State/Territory results (by sales volume):

Total Vehicle Sales – Year to Date: