Australians purchased 100,539 new vehicles in August 2025, marking the second strongest August result ever recorded.

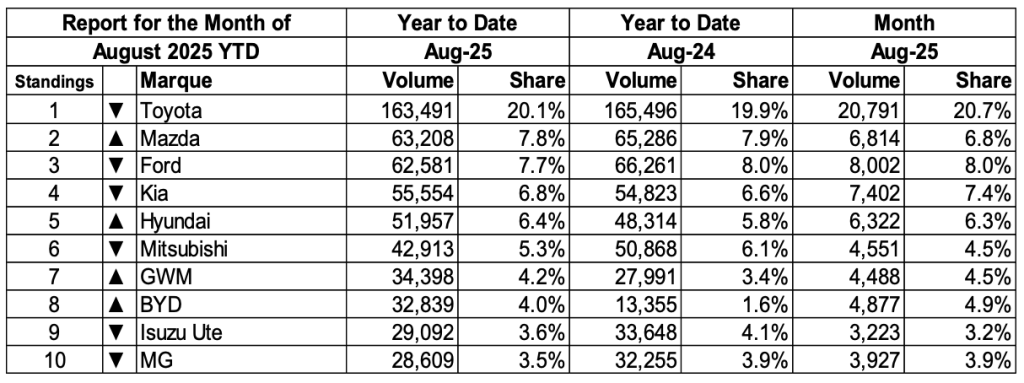

For the first time, four Chinese brands — BYD, GWM, MG and Chery — are in the national top ten. A total of 20,070 Chinese-made vehicles were sold in August, which was 67 per cent higher than in August 2024.

Federal Chamber of Automotive Industries chief executive Tony Weber said the figures showed how quickly the industry – and consumers – are adapting to new options.

“The presence of four Chinese brands in the top ten illustrates the continuing evolution of the automotive landscape in Australia. Consumers have an extraordinary range of vehicles to choose from – more than 400 models, including around 100 EVs,” Mr Weber said.

Overall, SUVs continued to dominate, with 60,495 sales in August representing 60 per cent of the market. Passenger cars made up 13.1 per cent of sales in August, and year-to-date sales are down 25 per cent compared with the same period last year.

Electric vehicles represented 6.8 per cent of VFACTS-recorded sales in August, while plug-in hybrid electric vehicles accounted for 3.9 per cent.

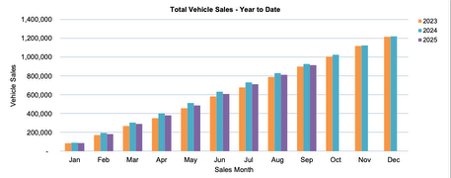

So far in 2025, 812,447 vehicles have been sold, compared with 830,226 for the same period last year, representing a modest decline of 2.1 per cent.

Ahead of the meeting of the Council of Treasurers this Friday, Mr Weber said the time was right for a federally led road user charge as a part of broader tax reform in the sector.

“FCAI has long been a supporter of a nationally consistent road user charge that ultimately can be applied to all types of vehicles, not just EVs. As the number of electrified vehicles increases, governments must support a smooth transition away from fuel excise. A road user charge is needed to provide an enduring revenue stream to support road and recharging infrastructure,” Mr Weber said.

Toyota was the market leader with sales of 20,791 during August, followed by Ford (8,002), Kia (7,402), Mazda (6,814) and Hyundai (6,322).

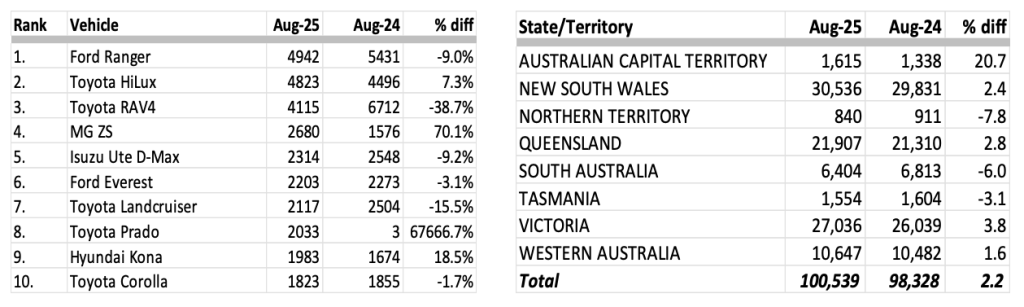

Sales in the Australian Capital Territory were up 20.7 per cent on August 2024 to 1,615; New South Wales was up 2.4 per cent (30,536); Northern Territory was down 7.8 per cent (840); Queensland rose 2.8 per cent (21,907); South Australia fell 6.0 per cent (6,404); Tasmania decreased 3.1 per cent (1,554); Victoria was up 3.8 per cent (27,036) and Western Australia rose 1.6 per cent (10,647).

VFACTS AUGUST 2025

Summary by Class:

Key Points:

- The August 2025 market of 100,539 shows an increase in new vehicle sales of 2,211 (2.2%) compared to August 2024 (98,328). There were 26 selling days in August 2024 compared to 27 in August 2025 resulting in an increase of 225.1 vehicle sales per day in August 2025.

- The Passenger Vehicle Market is down by 1,963 vehicle sales (-12.9%) over the same month last year; the Sports Utility Market is up by 3,954 vehicle sales (7.0%); the Light Commercial Market is up by 704 vehicle sales (3.1%) and the Heavy Commercial Vehicle Market is down by 484 vehicle sales (-11.8%) versus August 2024.

- Toyota was market leader in August, followed by Ford and Kia. Toyota led Ford with a margin of 12,789 vehicle sales and 12.7 market share points.

SALES RESULTS:

Top 10 Models (by sales volume): State/Territory results (by sales volume):

Total Vehicle Sales – Year to Date:

VFACTS monthly vehicle sales data is available on the third working day after the end of every month.